How our fees work: Unlike many firms we do not charge by the hour. Once we have all or at least all material information required to prepare the return or project we determine our fee based on your unique tax and accounting needs. This comes down to the time it will take us to prepare, review and finalize the return or project based on the complexity of the services needed.

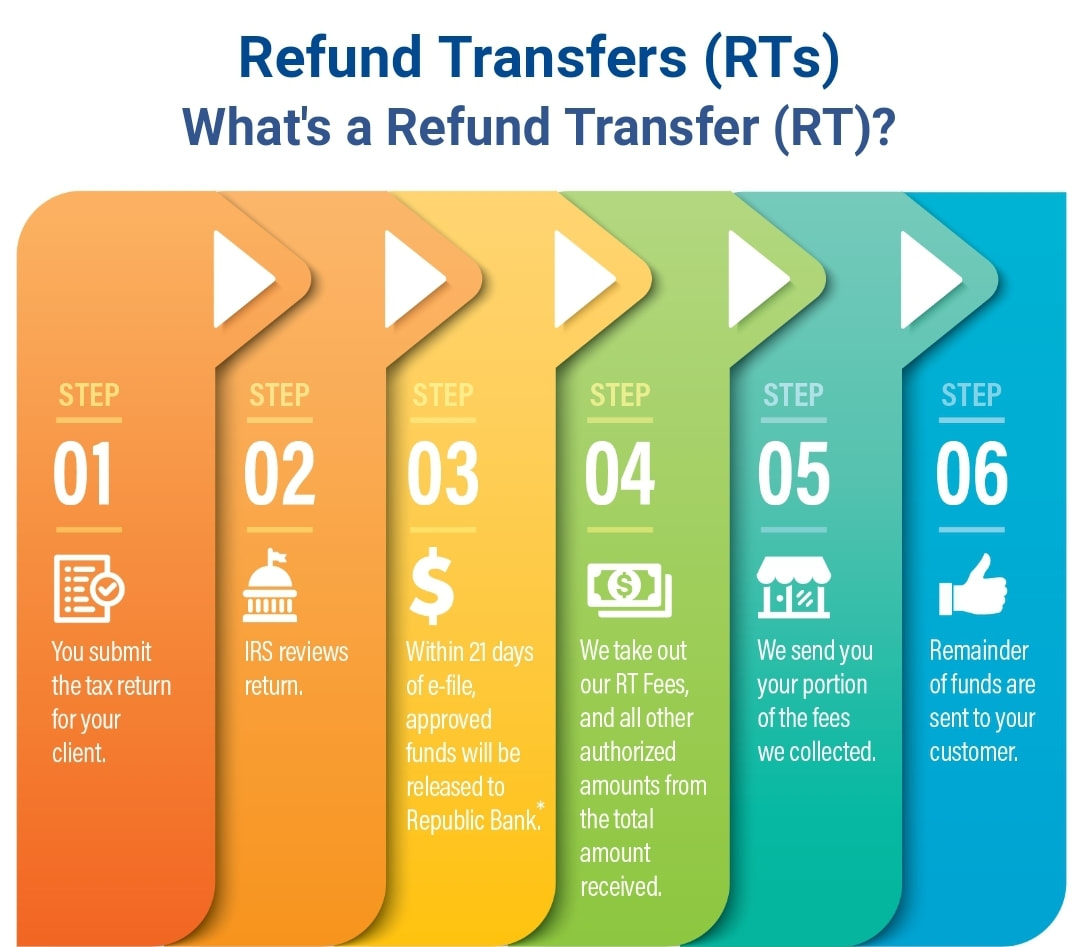

We have 2 payment options to pay for your tax preparation services. Eligible customers can choose from the Refund Transfer option or pay upfront. If a customer pays up front a 50% deposit is required to behin preparation and is due upon transmitting or submitting to the IRS.

We have 2 payment options to pay for your tax preparation services. Eligible customers can choose from the Refund Transfer option or pay upfront. If a customer pays up front a 50% deposit is required to behin preparation and is due upon transmitting or submitting to the IRS.

Global Tax Service LLC Fees for Services

Pricing subject to change, adjusted to meet individual clients unique needs and discounted when multiple services utilized. We work with all clients to determine how we can work together to meet their tax and accounting needs at a price they can afford. Fees are determined and agreed upon once ALL information is received and prior to beginning any work. Tax preparation fees do not include audit support.

15% Military Discount

50% of Fee Is Due Prior to Work Beginning.

Balance is due when draft is provided. Final copy and e-filing will not be provided until balance is paid.

New Business Set Up

Articles of Organization or Incorporation

Base rate $300 and up

Does not include State Fee (varies by state)

Tax Identification Number $150.00

S-Corporation Election $175

Articles of Organization Amendments $150

New QuickBooks/Wave Set-Up Base - $500 plus hourly rate after minimum 5 hours.

Preparation and Electronic Filing of Form 1023-EZ Federal application for tax exempt status $500

Does Not Included Federal Fee (About $400)

Preparation of form 1023 Federal Application for Tax Exempt Status

Small Tax-Exempt entities average $600 – $1,500 – Does Not Include Federal Fee (About $400 to $850)

Business Consultation Services

$150.00 initial consult fee and $100 per hour thereafter. Packages available.

Bookkeeping Service

Monthly/Quarterly Bookkeeping Services

Small Businesses starting at $150 per month (3 hour minimum)

Quarterly Quickbooks Review and Reconciliation

Small businesses average per quarter

$400 – $1,000

Annual Quickbooks Review and Reconcilliation

Small businesses average per quarter

$600 – $1,500

Quarterly Financial Statement Preparation

Small businesses average per quarter

$400 – $1,000

Annual Financial Statement Preparation

Small business average $600 – $1,500

Tax Return Preparation & Filing

Individual Federal Income Tax Preparation

$150 and up (This is a base rate does not include bank fees or audit protection)

*1040 return and related statements, including cost of e-filing or mailing

Personal Federal AMENDED Income Tax Preparation

$160 and up

Amended 1040 return and related statements, including cost of mailing (does not include bank fees or audit support)

Personal State Income Tax Preparation

$30-$100.00

Return and all related forms, including cost of e-filing or mailing

(does not include bank fees audit support)

Business Federal Income Tax Preparation $600 – $1500 plus applicable fees

1120, 1120s, 1065 and all related forms, including cost of e-filing or mailing

(does not include bank fees or audit support)

Business State Income Tax Preparation $350 – $1000 plus applicable fees

Return and all related forms, including cost of e-filing or mailing

(does not include audit support)

Tax Exempt Federal Return Preparation $600 – $1200 plus applicable fees

Form 990’s and all related forms, including cost of e-filing or mailing

(does not include audit support)

Sales Tax Return Preparation

$150 per filing and up

Per state, per filing

(does not include audit support)

Payroll Federal & State Annual Return Preparation

$250 and up

W2/W3 Filings for Up to 5 Employees

($15 Each employee over 5)

(does not include audit support)

Payroll Quarterly Return Preparation

$150 and up per filing

Quarterly 941 and Applicable State Filings – Fee is per filing for up to 5 employees

($15 each employee over 5)

(does not include audit support)

Annual Federal 1099 Filing Preparation

$120.00

Filings for Up to 5 Contractors

($15 each additional contractor)

(does not include audit support)